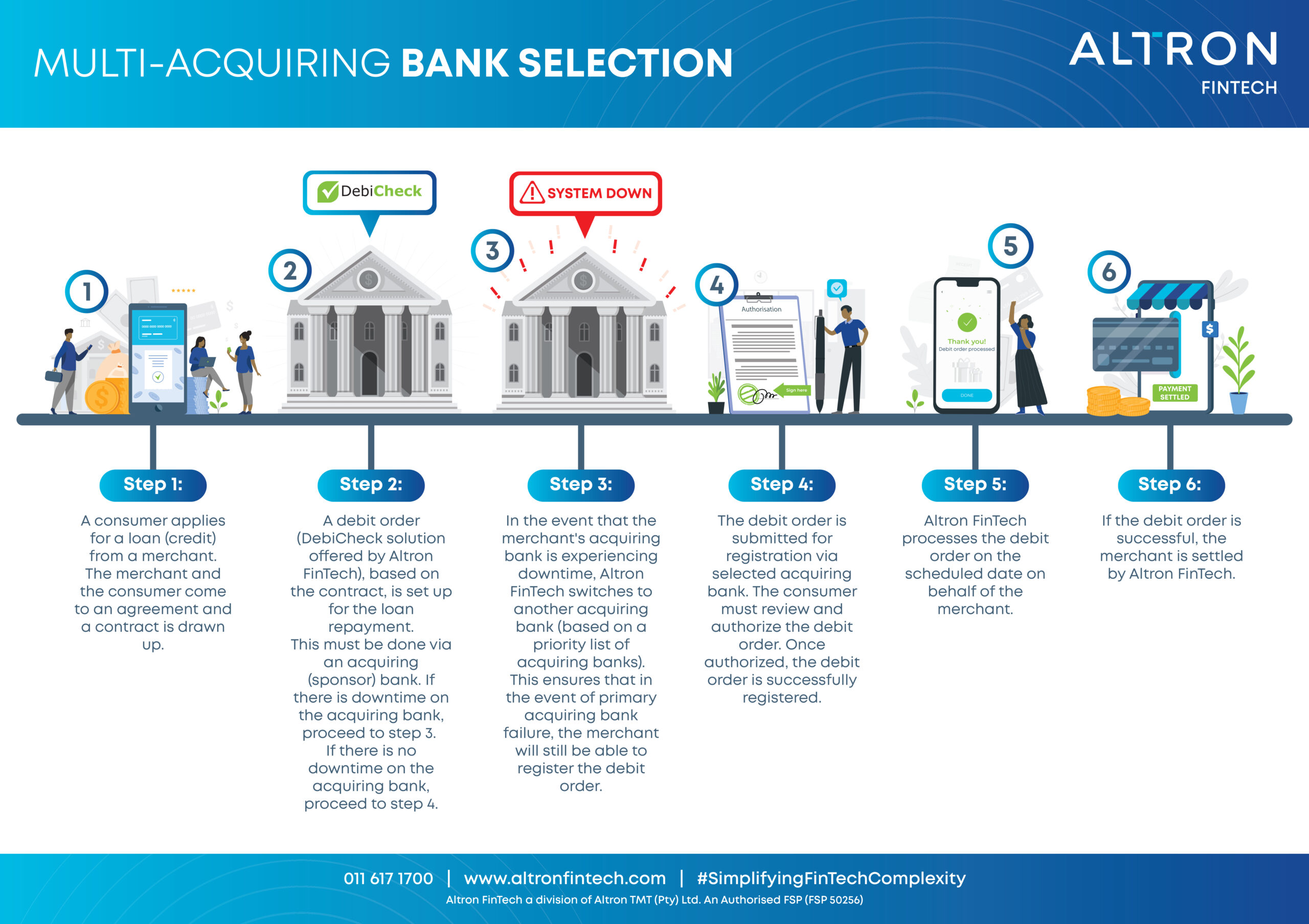

No transaction downtime with our multi-acquiring bank solution!

Experience uninterrupted transactions and reliable risk management with Altron FinTech’s Multi-Acquiring Bank Solutions.

We understand the need for comprehensive protection at Altron FinTech, which is why we provide cutting-edge multi-acquiring bank solutions with an emphasis on uninterrupted transactions and accurate risk management.

Make your first-choice processor your own business bank, or process where most of your customers’ bank, either way, you can also select to have a second or even a third bank as your backup solution in case of emergency. If one bank’s system goes down, we can switch you over to your backup choice in a few minutes to keep your business processing.

Experience the power of Altron FinTech’s multi-acquiring bank DebiCheck solution.

Don’t be caught without a processing bank, choose the only solution that switches your transactions and reports them all in one central process.

Merchants can be confident that their payment procedures will stay smooth and secure with our revolutionary DebiCheck and multi-acquiring bank solution. We prioritise reducing transaction downtime, allowing businesses to run their operations smoothly and without interruption. By utilising our multi-acquiring bank services, you obtain a safety net that reduces the risks connected with fraudulent transactions and payment disputes, providing your company with the ultimate peace of mind.

Choose Altron FinTech for a reliable payment environment, where our multi-acquiring bank solutions provide superior protection and continuous transaction capabilities, allowing you to survive in the ever-changing digital payment landscape.

DebiCheck payment authentication solution

DebiCheck is a payment authentication solution developed by the South African Reserve Bank. It requires customers to confirm debit orders before they are processed, ensuring that merchants receive payment from legitimate sources. The system also allows for real-time notifications of any changes made to customer accounts, giving merchants greater control and transparency over their payment processing.

DebiCheck with multiple acquiring banks

Altron FinTech’s DebiCheck solution stands out from the competition because it offers access to multiple acquiring banks. This means that merchants can choose the bank that best suits their needs and provides the lowest transaction fees. Additionally, having access to multiple banks ensures that merchants have a backup option in case one bank experiences technical difficulties or other issues that prevent payments from being processed.

Seamless Integration with Existing Payment Systems

Another advantage of Altron FinTech’s DebiCheck solution is that it can be easily integrated into existing payment systems. Merchants do not need to replace their current payment gateway to access the benefits of DebiCheck. This ensures a smooth transition to the new payment authentication system and reduces the risk of disruption to a merchant’s payment processing operations.

Secure and Flexible Multi-Acquiring Bank Solution

At Altron FinTech, we understand the importance of providing our merchants with a comprehensive payment processing solution. We believe that our multi-acquiring bank DebiCheck solution offers unparalleled security and flexibility. By offering access to multiple banks and seamless integration, we provide a safety net for our merchants, ensuring that they receive legitimate payments from their customers and can continue to operate their businesses with confidence.

Providing a safety net for merchants

Altron FinTech is the only service provider that offers a multi-acquiring bank DebiCheck solution, providing a safety net for our merchants. Our solution offers access to multiple banks, seamless integration, and unparalleled security and flexibility. If you’re a merchant looking to minimize payment fraud and disputes, contact us to learn more about our DebiCheck solution and how it can benefit your business.