Households remain under severe financial pressure, Download the index for further information.

Call us on 010 060 4444 or fill in some quick details and we'll call you.

The latest Altron FinTech Household Resilience Index confirms negative impact of high interest rates on household expenditure

Download Presentation

“High interest rates place downward pressure on the demand for household and business credit, which play a crucially important role in the expansion of economic activity,” says Botha.

Background to the AFHRI

In recognising the need for data that provides more clarity on the financial disposition of households in general, and their ability to cope with debt in particular, Altron FinTech commissioned economist and economic advisor to the Optimum Investment Group, Dr Roelof Botha, to assist in designing this index.

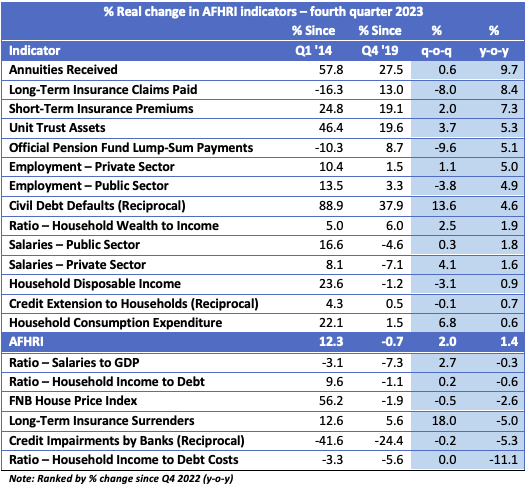

The index comprises 20 different indicators, all of which are directly or indirectly related to sources of income or asset values. The AFHRI is weighted according to the demand side of the short-term lending industry and calculated every quarter, with the first quarter of 2014 being the base period, equalling an index value of 100. All the indicators are expressed in real terms, i.e., after adjustment for inflation.

Media Release

The latest Altron FinTech Household Resilience Index confirms negative impact of high interest rates on household expenditure

According to economist Dr Roelof Botha

According to economist Dr Roelof Botha, who compiles the index on behalf of Altron FinTech, arguably the most worrying trend in the latest AFHRI is the year-on-year decline of more than 11% in the ratio of household income to debt costs. “In the fourth quarter of 2021, the start of the MPC’s restrictive monetary policy stance, households were sacrificing 6.7% of their disposable incomes to pay debt costs. This burden has now moved to 9% – an increase of more than 34%.”

Although the AFHRI for Q4 of 2023 recorded a year-on-year increase of 1.4%, six of the 20 constituent indicators remained in negative territory, whilst another three, including household disposable income, recorded growth of less than one percent.

Botha believes it is concerning that the index value remains lower than in the fourth quarter of 2019 – the last comparable quarter before the pandemic. Since the inception of the AFHRI (the first quarter of 2014), the financial disposition of households has increased by an annual average of only 1.2%, marginally higher than the paltry average annual real growth of 1.1% in the country’s GDP over this period.

The AFHRI has an inverse relationship with domestic lending rates – the higher the SARB’s repo rate (and the linked prime overdraft rate) – the higher the cost of credit and working capital, which negatively impacts the financial disposition of households.

“High interest rates place downward pressure on the demand for household and business credit, which play a crucially important role in the expansion of economic activity,” says Botha. “The economy has never been able to grow at sustained high levels in the absence of real growth in household credit extension.”

Over the past two years, the country’s benchmark prime lending rate (via the repo rate) has been raised consistently to almost 12% – the highest level in 14 years. “This has occurred even though both the producer price index (PPI) and the consumer price index (CPI) are comfortably within the Reserve Bank’s target range for inflation, i.e., 3% to 6%, and no sign whatsoever of demand inflation in the economy.”

The MD of Altron FinTech, Johan Gellatly

The MD of Altron FinTech, Johan Gellatly, says that while this most recent reading of the AFHRI shows the stark reality of the financial pressure South Africans are under, Altron FinTech’s clients are geared to trade effortlessly, even in tough times.

“Look, the reality is that consumers will continue to make ends meet, even with their disposable incomes under dire pressure because of the sustained period of extremely high interest rates. All indicators, the AFRHI included, clearly paint a picture that to start assisting consumers, interest rates must be lowered. This is equally important in terms of growing the economy, attracting investment, and reducing unemployment. Business SA is sitting on the sideline and playing a ‘wait-and-see game’ to ascertain whether they should invest or not due to the tight monetary policy. At Altron FinTech we are constantly applying our minds with our customers on how best we can use the resources at our disposal to grow our businesses and assist consumers by introducing cost-friendly products and services. ”

Gellatly also believes that Altron FinTech remains well positioned to assist customers in growing market share in their chosen market by leveraging the company’s innovative payment platform solutions.

The downside

In assessing the latest trends emanating from the constituent indicators of the AFHRI, the following may be regarded as red flags for short-term economic growth prospects:

-

In real terms, household credit extension remains lower than four years ago and is 4.2% lower than a decade ago. This negative trend has manifested itself in a subdued residential property market, with house prices continuing to decline in real terms. Since the MPC started raising lending rates, the number of applications for home loans administered by BetterBond has declined by almost 30% and the average deposit required for a mortgage loan by first-time home buyers has shot up to more than R200,000 – an increase of more than 100%.

-

Over the last year, credit impairments by banks have increased by more than 5% in real terms to a level of R194 billion.

-

Although household consumption expenditure, which is the dominant demand factor in the generation of GDP, increased at a healthy rate on a quarter-on-quarter basis, this was exclusively due to the traditional spending spree during the festive season and Black Friday/Cyber Monday, backed by end-of-the-year bonus payments to many salary earners. The year-on-year increase of only 0.6% in real terms equates to negative per capita growth, with the country’s average annual population growth rate over the past 11 years standing at 1.7%.

The bright side

Positive trends identified by the latest AFHRI include the following:

-

Since the third quarter of 2021, private sector employment has risen by almost 1.7 million, of which 243,000 new jobs were in the construction sector – clear signs of renewed business confidence and increased private sector capital formation.

-

Following a lengthy period of decline, real levels of labour remuneration in the private sector picked up in 2023, with year-on-year growth of 1.6% in the fourth quarter. Combined with sustained employment growth, these indicators represent the key reasons for the increase in the positive overall AFHRI trend.

-

The year-on-year real increase in the value of unit trust assets is welcome and has played its part in securing a positive growth rate for the ratio between household wealth and household income.

AFHRI trend based on a four-quarter average

The graph on the following page illustrates the AFHRI trend based on a four-quarter average, which eliminates seasonal variances. A pronounced recovery and new growth impetus occurred shortly after the worst of the COVID-19 period, but this was clearly halted in its tracks and then reversed by the restrictive monetary policy of the MPC.

“The inconsistency of monetary policy remains a point of huge concern for the millions of indebted households and businesses,” says Botha, adding that before the pandemic, the MPC was satisfied with a prime overdraft rate of 10%, with CPI within the inflation target range of 3% to 6%.

“Now, despite the absence of demand inflation, substantial unutilised production capacity, and the CPI within the target range, the prime rate is 11.75% – a full 175 basis points higher. The standard of living of South African households will not be lifted unless interest rates decline to substantially lower levels – at the very least to the prime rate that existed at the beginning of 2020, namely 10%.”

The table below summarises the performance of the different indicators comprising the AFHRI over four different periods, i.e.: since the base period (Q1 2014); since the last comparable quarter before the COVID-19 lockdowns – Q4 2019; quarter-on-quarter; and year-on-year (percentage changes in real terms). The period since the fourth quarter of 2019 is regarded as relevant to gauge whether the financial resilience of households has fully recovered from the pandemic or not.